Health

World

Technology

RNFI Services Ltd Acquires Payworld to Boost Fintech Capabilities and Financial Inclusion

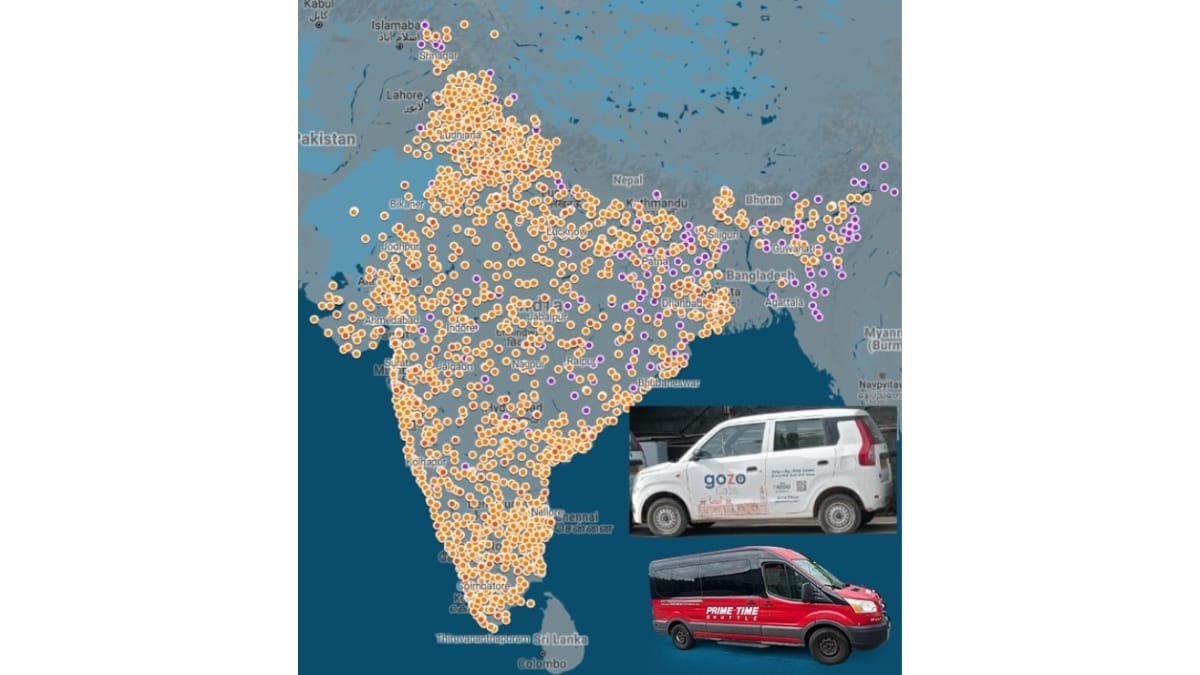

New Delhi [India], October 19: RNFI Services Ltd, a prominent player in the fintech industry, has officially announced a binding agreement to acquire Payworld Digital Services Private Limited. Payworld, known for its comprehensive suite of digital payment solutions and strong focus on financial inclusion, is set to join forces with RNFI, promising an even broader array of services and enhanced capabilities for both entities. This strategic move marks a pivotal development in RNFI’s mission to transform financial technology and bridge the gap between traditional banking and underserved communities in India.

Strategic Objectives and Impact of the Acquisition

The primary objective of this acquisition is to leverage the synergies between RNFI and Payworld, creating a fintech powerhouse that combines the strengths and capabilities of both companies. RNFI aims to significantly enhance its position in the fintech sector by integrating Payworld’s well-established digital payment solutions and extensive customer base into its own operations. The acquisition is designed to bring about a substantial expansion in RNFI’s service offerings, technological infrastructure, and customer reach.

By incorporating Payworld’s assets and expertise, RNFI plans to expand its presence across various markets, reaching out to diverse clientele and enhancing the delivery of financial services to meet the evolving needs of the digital economy. Both companies have demonstrated a firm commitment to promoting financial inclusion, and this acquisition will further strengthen those efforts, particularly in underserved communities across India.

Key Highlights of the Acquisition Agreement

1. Expanded Product Portfolio: The acquisition will enable RNFI to diversify and enhance its range of financial services. By incorporating Payworld’s innovative digital payment solutions into its offerings, RNFI aims to expand its portfolio to include advanced payment solutions and loan services. This integration will allow RNFI to provide customers with a more comprehensive suite of services, addressing various financial needs and challenges faced by users in both urban and rural areas.

2. Increased Market Penetration: Payworld’s established presence in the market will serve as a valuable asset for RNFI, helping it to increase its market penetration and reach a wider audience. Payworld’s customer base, which spans across diverse regions and demographics, will be integrated into RNFI’s operations, enhancing the latter’s ability to deliver targeted services to a more varied clientele. This expanded reach is expected to solidify RNFI’s standing as a leading fintech service provider in India, while also opening new avenues for growth and development.

3. Synergistic Technology Integration: The integration of Payworld’s technological infrastructure with RNFI’s existing systems will create a more robust and innovative platform for service delivery. This collaboration is expected to foster technological innovation, enabling RNFI to enhance customer experiences by providing more efficient, reliable, and secure digital payment solutions. The synergy between the two companies will drive the development of new technologies, ensuring that the combined entity remains at the forefront of the fintech sector and continues to meet the demands of an ever-evolving digital economy.

4. Focus on Financial Inclusion: Both RNFI and Payworld share a deep-rooted commitment to financial inclusion. By joining forces, the two companies aim to strengthen their efforts to provide accessible and affordable financial services to underserved communities across India. This acquisition will empower RNFI to bridge the gap between traditional banking services and marginalized populations, ensuring that individuals and businesses in these communities have access to reliable and customer-centric financial solutions. This focus on financial inclusion is central to RNFI’s long-term vision of creating a more inclusive and equitable financial ecosystem.

Impact on the Fintech Landscape

This acquisition represents a strategic milestone for RNFI, as it aligns with the company’s broader goal of transforming the fintech sector and promoting financial inclusion through innovative technology. By incorporating Payworld’s strengths, RNFI is positioned to significantly enhance its ability to provide digital payment solutions, credit services, and other financial products tailored to meet the unique needs of different customer segments.

The acquisition will also help RNFI to adapt to the changing dynamics of the fintech industry, where innovation and customer-centric solutions are becoming increasingly important. By combining its own expertise with that of Payworld, RNFI will be better equipped to deliver services that not only cater to urban customers but also reach remote and underserved regions of the country. This holistic approach is designed to create a meaningful impact, empowering individuals with greater access to financial services and contributing to the growth of India’s digital economy.

Integration and Future Roadmap

The integration process between RNFI and Payworld will commence immediately. Both companies have committed to working closely together to ensure a smooth and seamless transition, minimizing disruptions to ongoing services. The integration will involve a detailed collaboration between the technical and operational teams of both companies, ensuring that all systems and processes are aligned for optimal efficiency and service delivery.

RNFI is dedicated to maintaining the high standards of excellence that both companies have been known for, and the focus will be on creating a unified platform that leverages the best aspects of both entities. The aim is to provide customers with enhanced financial products and services that are innovative, secure, and easy to use. With the combined expertise of RNFI and Payworld, the newly integrated entity is expected to set new benchmarks in the industry, driving innovation and expanding access to financial services for millions of people across India.

Commitment to Excellence and Service Continuity

RNFI assures its customers and stakeholders that this acquisition will only enhance their experience, with a focus on continuity and excellence in service delivery. The company emphasizes that its mission to promote financial inclusion and empower communities will remain at the forefront of its operations, ensuring that all customers benefit from the expanded range of services and improved technological capabilities.

For further information on the acquisition and its impact, stakeholders are encouraged to contact RNFI Services Ltd via email at info@rnfiservices.com.

Conclusion

The acquisition of Payworld Digital Services Private Limited is a major step forward for RNFI Services Ltd, reinforcing its position as a leader in the fintech industry and a champion of financial inclusion. By integrating Payworld’s offerings and customer base, RNFI is poised to deliver more comprehensive and impactful financial solutions, driving growth and development across India’s digital landscape.

LinkedIn: https://www.linkedin.com/company/rnfiservicesofficial/posts/

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.

National

Sa-Dhan to Host 19th National Conference on Inclusive Growth with Focus on Sustainable Development

New Delhi [India], October 22: Sa-Dhan, the first and the largest association of impact finance institutions, which includes MFIs, mainly a Self-regulatory organisation (SRO) recognised by RBI for microfinance institutions, is organising its 19th National Conference on Inclusive Growth, on October 23-24, 2024, at The Ashok, New Delhi. The conference, themed “Driving Sustainable Development through Inclusive Finance,” will bring together leading figures from government, banking, and the microfinance sector.

The two-day conference will have 13 sessions on various sustainable and inclusive growth agenda topics with 78 speakers participating in the discussions. The speaker list features distinguished personnel, including Dr. Sourabh Garg, IAS, Secretary, MoSPI, Government of India; Mr. Shailesh K Singh, IAS, Secretary, Rural Development; and Mr. M Nagaraju, IAS, Secretary, DFS, Ministry of Finance. Other key speakers include Mr. Shaji KV, Chairman, NABARD; Mr. Manoj Mittal, CMD, SIDBI; and Mr. Jayant Kr Dash, ED, Reserve Bank of India.

The conference agenda encompasses critical discussions on sustainable microfinance, technological innovation, gender-responsive finance, and the future of microfinance in India. Special focus will be given to the “Lakhpati Didi” initiative and its role in elevating the Self-Help Group model to new level.

“The 19th edition of the conference will focus on inclusive growth and sustainable development, with a deeper understanding on various initiatives needed to uplift the poorer sections from financial exclusion and financial vulnerability and ushering financial wellbeing to the poorer households . The role microfinance in this would be discussed with special focus on the sustainability in the light of the regular occurrence of climate related events in the country which impact the poorer household the most.,” said Shri Jiji Mammen, Executive Director and CEO of Sa-Dhan.

The event will also feature prominent industry leaders including Dr. Charan Singh, Non-Executive Chairman, Punjab & Sindh Bank; Mr. T Koshy, MD & CEO, ONDC; Dr. Harsh Bhanwala, Chairman MCX , Madhav Nair Secretary IBA, Prof. Sriram IIM Bengaluru and industry leaders like Shri H P Singh, Sadaf Sayeed, Vineet Chattree, Debyajyoti Pattanaik and Purvi Bhavsar, among over 75 distinguished speakers from banking, microfinance, technology, and policy sectors.

“The Conference will give a new direction to the microfinance and ecosystem players keeping in view the recent developments, including new regulatory frame work and post covid credit growth in the sector. An exclusive session is there to discuss on the experience of new regulatory framework”

The conference will cover comprehensive sessions on sustainable microfinance as a catalyst for inclusive development, re-imagining microlending through technological innovation, green microfinance in the Asia Pacific Region, strategic pathways for MFIs, and financial well-being of microfinance households.

The conference will conclude with a comprehensive discussion on “Microfinance 2034,” exploring the sector’s future role in India’s development story.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.

Education

Latest News

A Journey Through Life’s Stories: Amit Patil’s “Oblivion Express and Other Stories”

New Delhi October 22: In the breakneck and often frantic world we live in, stories offer us a chance to pause, reflect, and reconnect with the essence of life. Amit…

Sa-Dhan to Host 19th National Conference on Inclusive Growth with Focus on Sustainable Development

New Delhi , October 22: Sa-Dhan, the first and the largest association of impact finance institutions, which includes MFIs, mainly a Self-regulatory organisation (SRO) recognised by RBI for microfinance institutions,…

Usha Financial Services Limited IPO Opens on October 24, 2024

Mumbai (Maharashtra) , October 21: Usha Financial Services Limited, operates as a non-banking finance company that provides lending solutions and a diversified range of financial products, proposes to open its…

TRANSSION India and Allied Waste Solutions Host 200 plus for E-Waste Drive on International E-Waste Day

New Delhi October 22: At Transsion India’s office on the bustling Noida Expressway, over 200 participants gathered on October 14, 2024, to address one of India’s most pressing environmental challenges:…

Luxoria Group- Integrity, Growth, and Social Responsibility in Dholera Smart City’s Real Estate Boom

New Delhi , October 19: In India’s evolving real estate market, Luxoria Group stands out for its ethical approach, remarkable growth, and dedication to social responsibility. As a key player…